A market segment, which contains the word 'things' is evidently going to become prone to a variety of interpretations and this is definitely the case with the Internet of Things (IoT.) Nevertheless, the market for IoT in healthcare has been forecasted to reach a very significant market size, for instance $117b by 2020 according to Mind Commerce. For such an influential trend, there is widespread confusion around what this term actually means and what it includes.

For this reason, this blog post will attempt to consolidate three basic definitions into one with an aim to encompass the majority of potential aspects of IoT. It's important to note that there are much deeper descriptions behind these but we're looking for the core sentence that summarize what the market actually is.

---

Horses for Sources (HfS)

HfS defines IoT as: 'The association of data to a physical device and the delivery of this data from that device to a centralized repository for further processing.'

This description focuses on the data and how it is managed and processed with the physical devices simply being the enabler of the market. With this in mind, vendors who have strong capabilities in data management are likely to score highly in HfS's estimations.

---

Gartner

Gartner defines IoT as: 'The network of physical objects that contain embedded technology to communicate and sense or interact with their internal states or the external environment.'

Gartner's definition focuses a lot more heavily on the devices and does not feature the word 'data' at all although it is definitely implied. Gartner also uses additional vocabulary in 'sense' and 'interact'. It's important to note that sensors, especially within the healthcare market are an integral part of IoT as they not only facilitate data transfer but in a lot of cases, they carry it out proactively.

---

IDC

IDC defines IoT as: 'a network of networks of uniquely identifiable endpoints (or "things") that communicate without human interaction using IP connectivity — whether locally or globally.'

Following on from the point I made above about sensors carrying out data transfer proactively, IDC's definition highlights that IoT does not require human interaction. This aspect will provoke one of two reactions: 1) 'Fantastic, without human interaction means streamlined processes and the ability to focus our efforts on end users', or 2) 'Hmm, I'm not sure I trust endpoints communicating without human interaction.' Whilst IoT has a multitude of benefits, concerns over security must be addressed.

---

Each of these definitions have their own merits and by no means are any of them wrong. At this point, I would like to propose an amalgamation of these definitions and include a nod to security, which I personally believe is critical to include for successful client interactions on an enterprise level.

My definition would be: 'The secure communication of data which occurs between a network of endpoints and centralized repositories via IP connectivity for further processing.'

This blog post may seem trivial in nature but it is this lack of standard definition that is leading to a lack of standards. This lack of standards then naturally leads onto security concerns, which is the number one barrier to IoT adoption across all vertical industries.

What do you think? Do you agree with these definitions? Do you see a light at the end of the tunnel as it pertains to global standards for IoT? Please feel free to comment below and share on social media.

Best Regards,

Jonathan Cordwell

Research Analyst, Healthcare Strategy

ResearchNetwork, CSC

- Aria Systems, Healthcare: A $117B opportunity for the Internet of Things, Healthcare: A $117B opportunity for the Internet of Things - See more at: https://www.ariasystems.com/blog/healthcare-a-117b-opportunity-for-the-internet-of-things/#sthash.YR2SaIEg.dpuf

- Horses for Sources, Harman, Tech Mahindra, IBM, Accenture and Atos leading the Internet of Things phenomenon, 3rd Oct, 2015, http://www.horsesforsources.com/hfs-iot-blueprint_100315

- Gartner, Internet of Things, http://www.gartner.com/it-glossary/internet-of-things/

- IDC, IDC Market in a Minute: Internet of Things, http://www.idc.com/downloads/idc_market_in_a_minute_iot_infographic.pdf

Following on from last week's blog post about how Blockchain is being used in healthcare, this week I wanted to focus on some of the vendors who have won competitions with their use cases which in turn, raise the profile of Blockchain in general. Despite the prize money being relatively insignificant, the real prize is exposure to potential partners who could bring these ideas to their established client bases. This blog post will look at two Blockchain startups who have won prizes for their ideas as well as startups to keep on the radar.

MedVault

MedVault very recently won a Blockchain Hackathon competition held in Ireland. MedVault's proof-of-concept centered on the use of Blockchain to store medical records whilst preserving anonymity. This would then leverage the technology of a fellow startup Colu to avoid bloating the Blockchain. As we saw from my last blog post, similar projects are being developed by the likes of Factom and BitHealth.

In my personal opinion, this is going to be the most widely marketed use case within the healthcare market as data security is a key concern within the industry. Another very important point to note is that this competition was sponsored by Fidelity Investments, Citi and Deloitte. Partnering a consulting giant such as Deloitte with a startup in this field could prove fruitful so this is definitely one to watch.

Tierion

In September, a team led by Tierion CEO Wayne Vaughan, won the Consensus 2015 Makeathon competition. Tierion's team consisted of members from Citi, New York University, Apttus and Coin Cafe. The brief as stated on CoinDesk was to come up with 'an application that envisioned how the Blockchain could be used to produce verifiable, immutable receipts for use during an insurance claims process'.

During the competition, the team created an app for financial giant USAA (once again providing great exposure.) This app was integrated with Tierion's blockchain receipt technology and Google Sheets so that claims could be both automatically checked against the Bitcoin Blockchain and organized in documents for end-users.

Although this was created for a financial services client, there are two important aspects I'd like to mention. Firstly, the potential for cross pollination of Blockchain applications from financial serves into the health insurance space is very real. Healthcare payers will undoubtedly keep an eye on how it is being adopted within the financial sector to see if there are elements that can be leveraged.

Secondly, Tierion recently announced a partnership with Philips Healthcare to look into potential applications of Blockchain technology within the vertical. Tierion will pull from these experiences in the hope of reaching a much wider market through its partner network. Exposure to new markets will enable Tierion to expand quickly whilst benefitting from the reputation of an established player such as Philips.

Although a lot will evidently be focused on the financial sector, expect to see more of these types of sponsored events as startups rally together to raise the profile of Blockchain and progressively move its way into the limelight.

Ones to watch

Although not a financial prize, VentureRadar produced the graphic below recognizing their top 25 Blockchain startups that are disrupting non-financial markets. Tierion (as mentioned above) is featured as well as BlockVerify who was featured in my last blog post. Obviously there is a much wider field in the financial services sector but it's encouraging to see that startups are starting to branch out. It will be interesting to see whether anymore of these venture into healthcare and who they partner with to accelerate their path to market.

Are there any other Blockchain startups that are making their way into the healthcare market? Who do you think will be making waves in the coming months and years? Leave your comments below and please share via Twitter.

Best Regards,

Jonathan Cordwell

Research Analyst, Healthcare Strategy

ResearchNetwork, CSC

- CoinDesk, Medical Records Project Wins Top Prize at Blockchain Hackathon, 10th Nov 2015, http://www.coindesk.com/medvault-wins-e5000-at-deloitte-sponsored-blockchain-hackathon/

- CoinDesk, Blockchain Insurance Solution Wins Consensus 2015 Makeathon, 10th Sep 2015, http://www.coindesk.com/blockchain-insurance-consensus-2015-makeathon/

- VentureRadar, Top 25 non-financial Blockchain startups, http://blog.ventureradar.com/2015/09/08/top-25-non-financial-blockchain-startups/

This month, I've been looking at a very interesting topic that is receiving an increasing amount of attention within the IT landscape; Blockchain. Blockchain is a public ledger of transactions, which was originally founded to cater to Bitcoin transactions. Although Blockchain is much more well established within the financial services sector, it is gradually making its way into other industries such as healthcare. Previously theoretical use cases are now being acted upon by innovators in the market. This blog post will look at five examples of how it is being adopted within healthcare and life sciences:

EHR storage & security

- Blockchain is a security technology at its core and with the ever-present concern over the security of electronic health records, it is likely to cater to this challenge first as it enters healthcare. Factom, a provider of Blockchain technology, recently announced a partnership with HealthNautica, a medical records and services solutions provider. Their joint aim is to secure medical records and audit trails using the Blockchain. They will do this by cryptographically encoding private medical data and then a digital fingerprint is formed for time-stamping and verification purposes. This facilitates both the storage of the EHR and its security but what is also interesting is that organizations are also looking into how healthcare providers can send out encrypted personalized medical recommendations, which the user can access with their own, unique key.

DNA wallets

- An Israeli startup named DNA.Bits is planning to store genetic and medical data which is again secured via the blockchain and accessed using private keys and this will form a "DNA wallet". This could allow healthcare providers to securely share – and possibly monetize – patient data, helping pharmaceutical companies to tailor drugs more efficiently. What's striking about this is that the article was published over a year ago in June of 2014, which really highlights that this kind of development is becoming well established.

Bitcoin payments

- In a similar style to Factom and HealthNautica, BitHealth is also looking to store and secure medical records using the blockchain. This system also facilitates Bitcoin payments, giving patients additional options for how they pay their healthcare insurers. Although this relies on the success rate of Bitcoin in the market, insurers who offer this method will have a competitive advantage over their peers. With regards to health insurers, due to blockchain being established within the financial services sector, it is expected that lessons learned will cross over.

Anti-counterfeit drugs

- BlockVerify is looking to use blockchain in the fight against counterfeit drugs. In a similar way to M-Pedigree technologies, it features panels on drug packages that can be peeled or scratched off to reveal a unique verification tag. This is then cross referenced with the blockchain to ensure that the pharmaceutical product is legitimate.

Protein folding

- Stanford University previously relied on expensive super computers to simulate protein folding as it happens incredibly fast. This method was obviously costly and had a single point of failure. Using the blockchain, they can instead use a decentralized network of over 170,000 computers to produce 40,000 teraflops of computing power. This example will grab the attention of other industries that utilize expensive supercomputers. This could even make its way into the analytical space by utilizing a broad base of data for predictive analytics.

Clearly these are all cutting-edge innovations, but as with the financial sector, they point the way for mainstream adoption. Have you heard any other rumblings of how Blockchain is being used in healthcare and life sciences? How else do you think this new technology could be applied to add value to customers? I'd love to hear what you think. Please comment below and if you've enjoyed this post, please share on social media.

Best Regards,

Jonathan Cordwell

Research Analyst, Healthcare Strategy

ResearchNetwork, CSC

- Factom, HealthNautica + Factom Announce Partnership, http://blog.factom.org/post/117173667784/healthnautica-factom-announce-partnership, 23rd Apr 2015

- City A.M., Blockchain breaks new ground with DNA wallet, http://www.cityam.com/1403865514/blockchain-breaks-new-ground-dna-wallet, 27 Jun 2014

- BitHealth, http://devpost.com/software/bithealth

- The Coin Front, Block Verify to fight medical counterfeiting problem, http://thecoinfront.com/block-verify-to-fight-medical-counterfeiting-problem/, 11th Mar 2015

- Daily Trading Profits, New Uses For Blockchain Technology, http://www.dailytradingprofits.com/1279/new-uses-for-blockchain-technology/, 6th October 2014

The EHR landscape is dominated by a few select vendors. One of those is Epic Systems. There is no shortage of analytical commentary on the strengths and weaknesses of this otherwise secretive organization. This blog will discuss a few potential strategy options for Epic going forward.

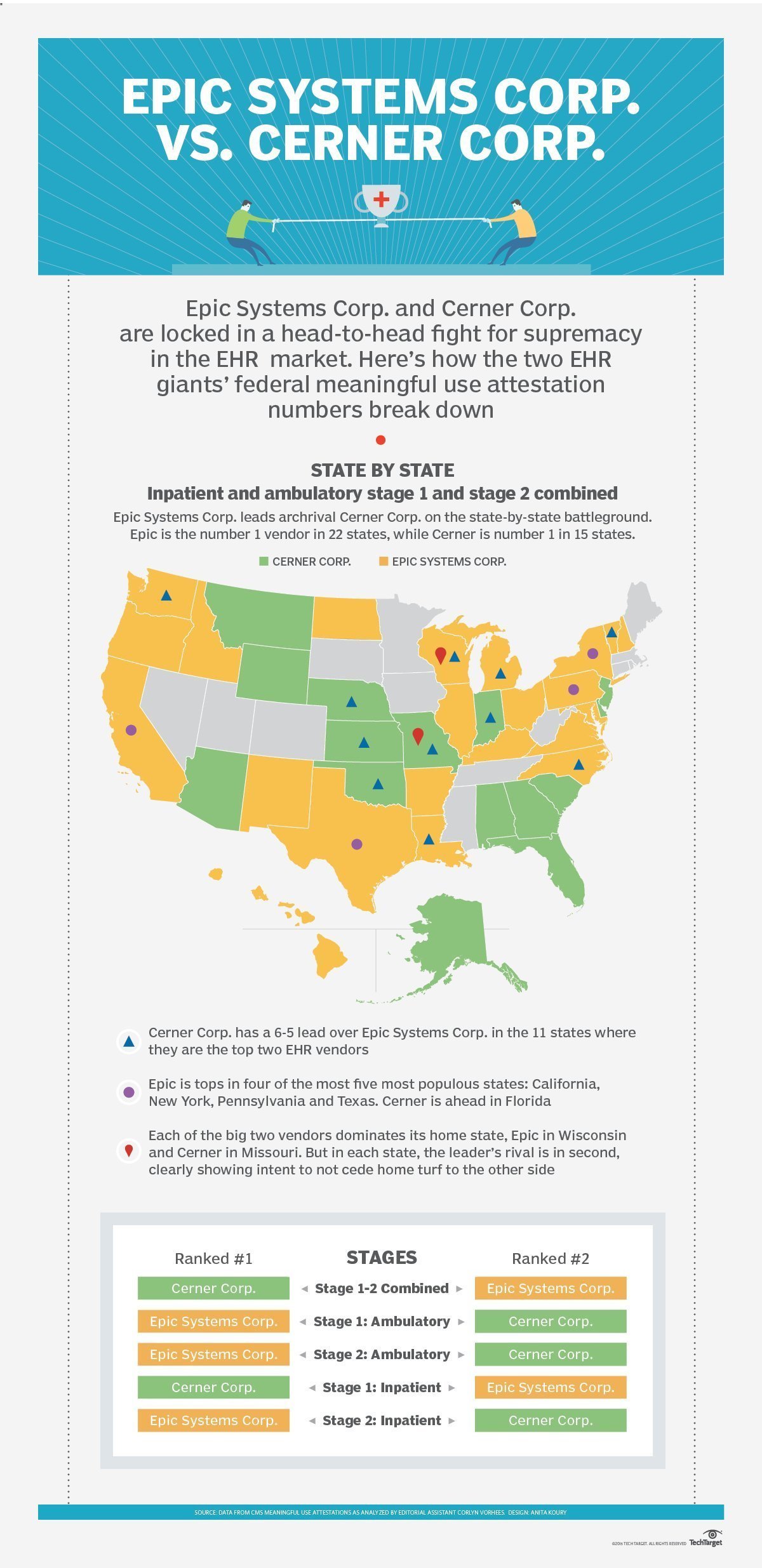

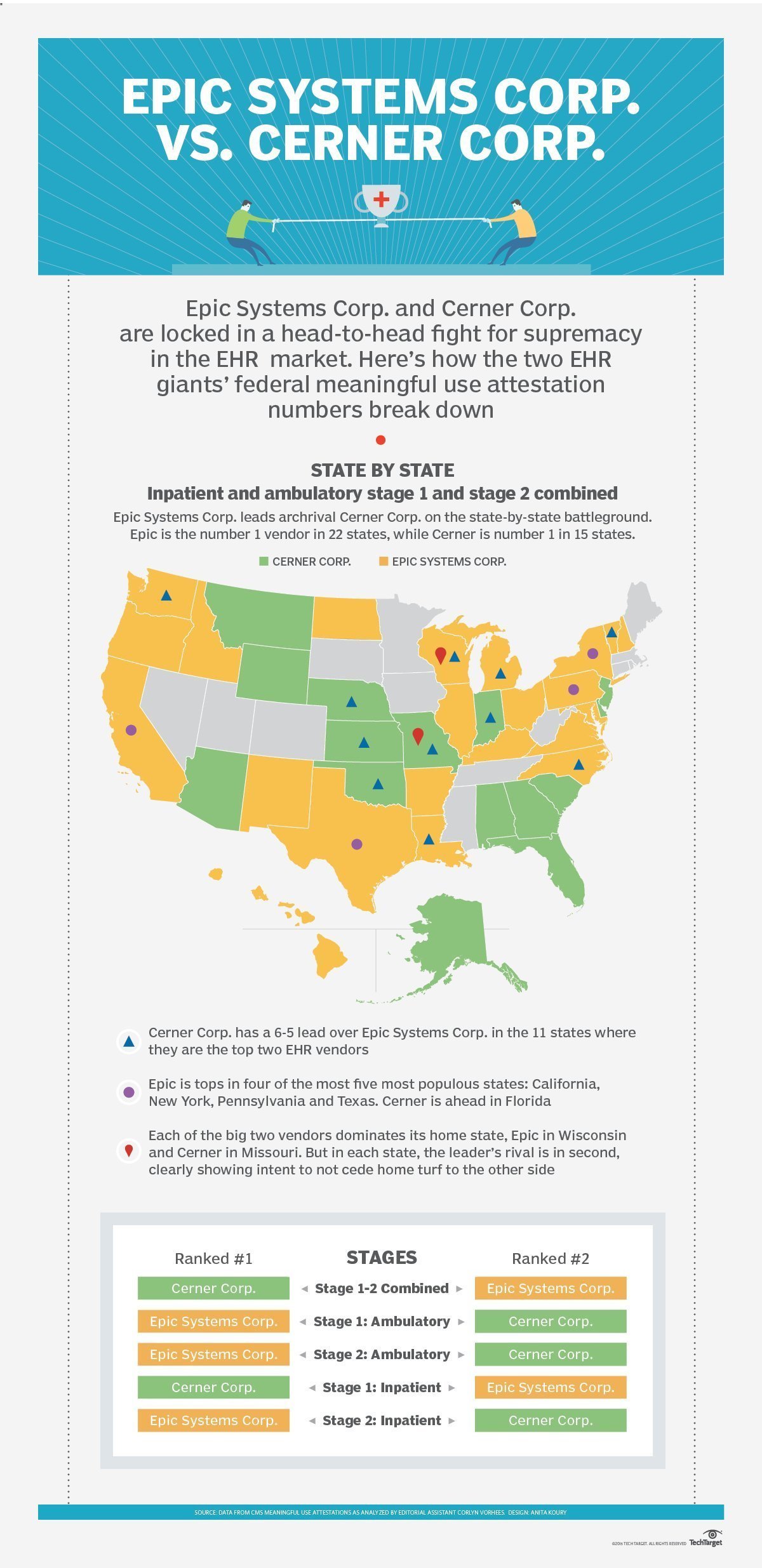

- Global expansion: Epic and Cerner are currently in a battle to gain the majority share of the US market. As you can see in the infographic below, Epic is #1 in 22 states and Cerner is #1 in 15 states. A recent survey also found that Epic is poised to gain even more market share due to prominent mind share so there is still a lot of opportunity to be had. As the battle to gain market share in the US is fierce, Epic will also look to move further into other regions to offset the saturating US market. However, a recent deployment at Cambridge University Hospitals in the UK has led to significant financial issues. Epic's premium pricing position has led to the $300m implementation being met with cynicism over the proposal's value for money. If Epic is to penetrate other regions effectively, it will need to find ways to reduce initial cost outlay.

- Solution improvement in interoperability: Despite scoring the highest mark for interoperability among its competitors in a recent Healthcare IT News consumer survey, it remained the lowest scoring element of Epic's scorecard (see below.) This is evidently an industry wide issue that needs to be addressed.

- Bolster analytical capabilities with IBM's Watson: Epic has a large foundation of patient data and information. As it continues to gain market share in hosting this information, it will also aim to improve its analytical capabilities to derive real value from this data. Epic's experience with IBM on the DoD bid in working jointly with Mayo Clinic has forged a relationship which will see Epic explore how Watson's cognitive computing capabilities could be applied into Epic's EHR base.

- Develop mobile health applications: Epic announced in late 2014 that it is building a data center to transition its healthcare IT apps to a cloud-based model due to growing demand. Coupled with this, Epic also announced that it would be working with Apple to develop mobile health applications for Apple HealthKit. Cloud-based health applications connecting healthcare providers and patients to Epic's EHR will improve its standing in the mobility space.

Best Regards,

Jonathan Cordwell

Research Analyst, Healthcare Strategy

ResearchNetwork, CSC

- TechTarget, Infographic: Epic leads Cerner in battle for EHR market, http://searchhealthit.techtarget.com/news/4500250294/Infographic-Epic-leads-Cerner-in-battle-for-EHR-market, 21st Jul 2015

- EHR Intelligence, Epic Systems Tabbed to Expand Hold of Ambulatory EHR Market, https://ehrintelligence.com/news/epic-systems-tabbed-to-expand-hold-of-ambulatory-ehr-market, 13th Oct 2015

- Healthcare IT News, Epic EHR adds to UK hospital's financial mess, http://www.healthcareitnews.com/news/epic-ehr-adds-uk-hospital-money-woes, 28th Sep 2015

- Healthcare IT News, 2015 EHR Satisfaction Survey vendor report card: Epic, http://www.healthcareitnews.com/infographic/2015-ehr-satisfaction-survey-vendor-report-card-epic, 9th Sep 2015

I have recently been looking at the Life Sciences supply chain competitive landscape and in particular, a vendor called TraceLink. TraceLink labels itself as 'the world's largest track and trace network for connecting the Life Sciences supply chain and eliminating counterfeit drugs from the global marketplace'. It has also seen a few interesting developments as of late so here's a top 5 countdown along with my independent analysis, enjoy:

- Targetting the Brazilian market: TraceLink recently formed an alliance with Brazilian based pharma IT services and automation specialist, SPI. The motivation behind this move was to assist life sciences clients in meeting requirements for track-and-trace due in December 2015. Under these new regulations, life sciences organizations are required to have serialized and tracked three batches of product through the supply chain. This will then become mandatory for all pharmaceuticals one year later. TraceLink will benefit from early entry into the market, focusing on this regulation, but will draw attention from competitors eagerly watching how the market situation develops.

- Onboarding industry expertise: In July, TraceLink announced that it had brought three industry experts into its management team: Michael Ventura (Director, Industry Solutions) from GSK, Elizabeth Waldorf (Director, Global Traceability) from AMGEN and Marcel Zutter (Senior Implementation Program Manager, EMEA) from Abbott. Bringing in senior level management with decades worth of expertise at reputable Life Sciences organizations such as these only further validates TraceLink's commitment to the industry and aligns its strategy with market demand.

- Partnership with the Yankee Alliance: Very recently, TraceLink launched the Yankee Alliance Preferred Partner Program. This enables more than 12,000 Yankee Alliance member pharmacies, clinics, hospitals, care facilities and physician practices to take advantage of reduced rates of its Product Track software in order to comply with the US Drug Supply Chain Security Act (DSCSA.) It makes sense for an organization to adopt the industry standard solution and although interoperable tracking software may not be a priority right now, it may facilitate some trend analysis in the near future to determine best practices for supply chain optimization.

- Strong Q2 2015 results: Last month, TraceLink announced its Q2 results for 2015 and one of the highlights was that it had added 50 new customers within the quarter, resulting in a 76% increase in quarterly sales bookings and a 128% increase in year-over-year bookings. TraceLink also recorded a 178% year-over-year staff increase in Q2, exhibiting its growth potential. Growth in sales is primarily down to regulatory compliance pressures and although the full list of clients is not publically available, their expansion into Brazil is a definite contributor to these impressive figures.

- Nexus '15: TraceLink will be holding a track-and-trace event later this month to bring together experts and leaders from various disciplines to discuss track-and-trace strategies. Two major themes emerge from this announcement as TraceLink look to delve into how the Internet of Things (IoT) and Mobility will impact regulatory compliance. It will be interesting to see how TraceLink will prepare and react to the evolving regulatory landscape as new workflow processes become standard.

Many thanks for taking the time to read this blog. As always, if you found it useful and/or interesting, please share this on social media and if you have any comments or questions, please feel free to leave them below.

Best Regards,

Jonathan Cordwell

Research Analyst, Healthcare Strategy

ResearchNetwork, CSC

The Telegraph recently published an article based on the announcement that high street pharmacies will be given access to NHS medical records in a move that has provoked privacy campaigners. There are arguments both for and against this move, which I have listed below:

Con

- The process: A large part of the argument against this move is the way in which national policy has been implemented. The test sample on which this policy was based came from just 15 patients. This is very difficult to justify and unfortunately adds to the already significant level mistrust in policy makers.

- The hard sell: There is concern that giving access to sensitive data to large commercial high street pharmacies will lead to the targeting of vulnerable patients with hard sell tactics. Despite the likes of Tesco stating that they would never use this data to market to customers, campaigners are not convinced.

- Confusion over guidelines: The results of the small sample found that pharmacy staff were confused about getting consent from patients before accessing sensitive data. This issue needs to be addressed to avoid data breaches and misuse due to human error or lack of training.

- Data security: Another concern from patients is that loyalty cards may be linked to personal medical records. The number of healthcare data breaches in the past leads to concerns that as medical data would now be bundled with other personal data held by the retailer, the combined value of this data would become more attractive to hackers.

- Confidentiality: One of the most fundamental arguments against this move is that there still remains a large portion of the population who simply do not want to share their data. The NHS has tried to calm these concerns with the insistence that pharmacy staff gain permission before viewing this data but undoubtedly a lot will still be unhappy that they have access to it in the first place.

Pro

- A necessary step: The ultimate goal is for a fully integrated healthcare ecosystem whereby insurers, providers, pharmaceutical companies and indeed the patients work together to improve the health of individuals and the nation. There are a lot of benefits that come from sharing, accessing and utilizing data (especially in mass) but with data kept in silos, this is simply not possible.

- Results of the sample: Although the sample used was incredibly small, the results “proved extremely beneficial”. These benefits have come from individual sites and so if used on a national level (a la population health), economies of scale would be achieved as well as leveraging analytical capabilities to improve healthcare delivery.

- Personalized service: Enabling access to medical data will promote a personal and customized service for the individual patient. A personalized service which aims to improve the health of the population will ultimately also lead to cost savings for the healthcare ecosystem. The bargaining power (although often criticized) of large retailers such as Tesco could also lead to lower pharmaceutical costs.

- Less pressure on family doctors: NHS England claim that sharing medical data with high street pharmacies will ease pressure on family doctors. Doctors will benefit from better processes as well as having a clear view of what pharmaceutical products have been purchased. It's also important to consider that the flow of data should not be one way and can benefit providers as well as pharmacies.

- Reduction in improper medication: A comment on the article also pointed out that some patients may struggle to remember the types of medication they are taking as well as the dosages. With high street pharmacies able to access your file (with your consent), this will reduce the number of instances of patients purchasing and taking the wrong medication or under/overdosing.

Regardless of the criticisms of this rollout, with the right regulations, safeguards and guidelines in place, many commentators believe the personal and social benefits will be become apparent very quickly.

Best Regards,

Jonathan Cordwell

Research Analyst, Healthcare Strategy

ResearchNetwork, CSC

- The Telegraph, Boots, Tesco and Superdrug to get access to NHS medical records, 09 Aug 2015, http://www.telegraph.co.uk/news/health/11790711/Boots-Tesco-and-Superdrug-to-get-access-to-NHS-medical-records.html

For those following the healthcare IT market, you will more than likely already be aware of what has happened between Cognizant and Health Net. For those who are not, I shall quickly set the scene.

In August 2014, Cognizant won a seven year, $2.7b engagement with California-based care management provider Health Net. Service was due to commence in the second half of 2015 but in July, it was announced that Centene Corporation was intending to acquire Health Net, which would delay the contract until after the merger had been completed and may not even go ahead at all due to the overlap with Centene's current IT services vendor landscape. Cognizant instead was able to extend its existing applications outsourcing (AO) and business process outsourcing (BPO) services for Health Net out till 2020 at a value of $520m as well as being able to licence some of Health Net's IP.

So what can we learn from this?

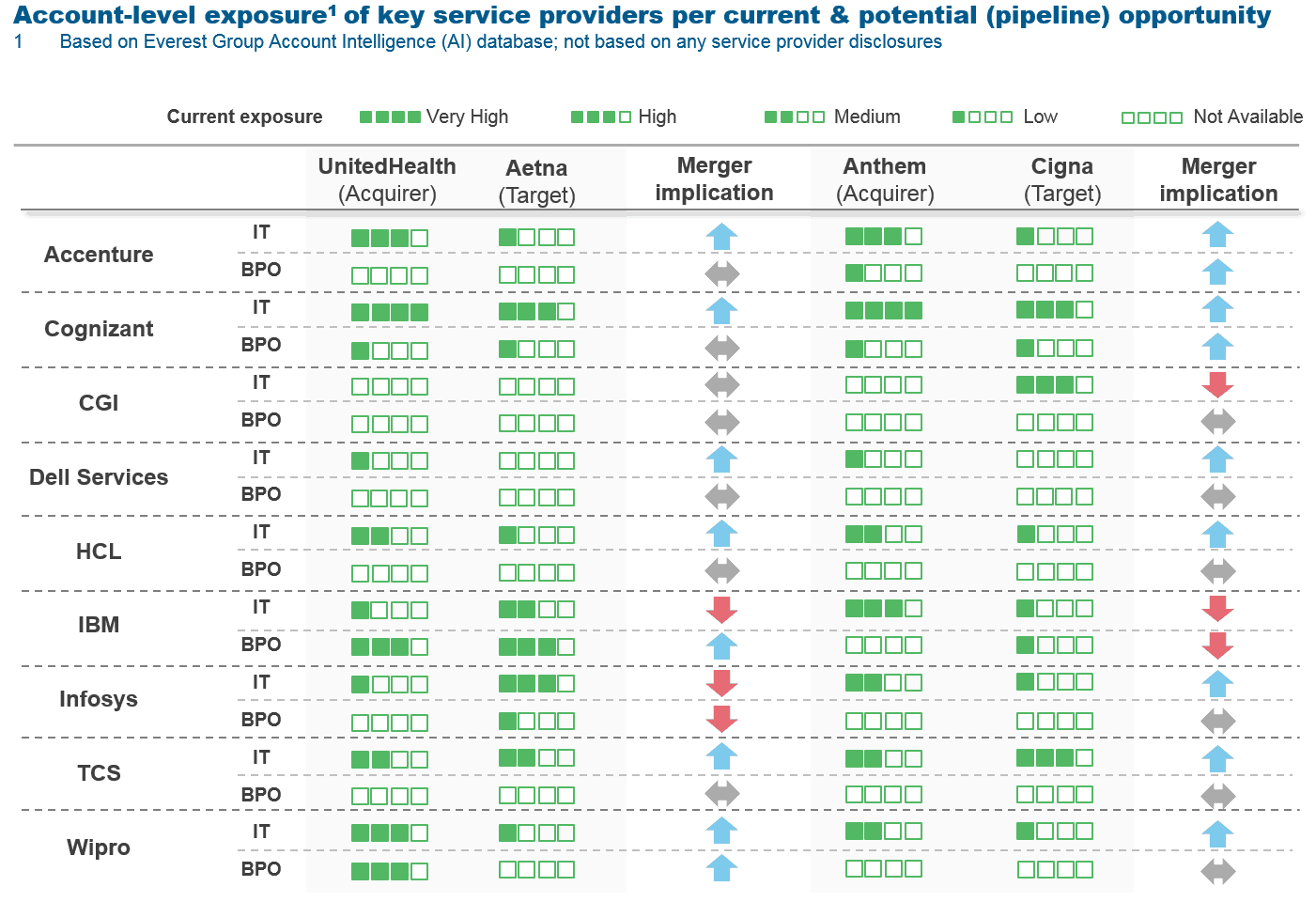

All IT service providers must be on red alert: The chart at the top of this page was produced by Everest (link to the article at the bottom) and shows how deeply entrenched IT vendors are within Healthcare Payer organizations. This chart acts as a warning to all vendors that they should be wary of their current client base and how it could potentially be affected by a merger/acquisition.

The Healthcare Payer ecosystem is shrinking: Centene's intent to acquire Health Net is just one of a series of acquisition announcements in the Healthcare Payer market this year. This was followed by Aetna's $37b purchase of Humana as well as Anthem's $54b purchase of Cigna. Suddenly, we're faced with a market where the top 7 have consolidated into a top 4 in a matter of weeks. There's even speculation that UnitedHealth Group may put in a counter offer for Health Net, which, if higher, would dissolve Centene's offer. These deals have been driven by market changes such as the Accountable Care Act (ACA) and the Supreme Court’s recent decision to subsidize poorer Americans. Keep an eye on UnitedHealth Group to see what its next move will be.

Consolidation equals both opportunities and threats for IT service providers: Although Cognizant's deal may have gone sour after the announcement, it looks as though they will survive after renegotiating the existing AO & BPO contract. As other Payers consolidate, existing deals may come under threat and clients may look to consolidate their vendor landscapes but new opportunities will arise as the newly merged organizations require IT support to ensure the transition goes smoothly and that IT systems are integrated properly.

Thank you once again for taking the time to stop by, I hope you found this interesting and thought provoking. If you have any comments, feel free to leave them below and share via social media.

Best Regards,

Jonathan Cordwell

Research Analyst, Healthcare Strategy

ResearchNetwork, CSC

- Everest, Health Net – Centene Merger Leaves a (Slightly) Bitter Pill for Cognizant, 6th July 2015, http://www.everestgrp.com/2015-07-health-net-centene-merger-leaves-a-slightly-bitter-pill-for-cognizant-sherpas-in-blue-shirts-18205.html