The EHR landscape is dominated by a few select vendors. One of those is Epic Systems. There is no shortage of analytical commentary on the strengths and weaknesses of this otherwise secretive organization. This blog will discuss a few potential strategy options for Epic going forward.

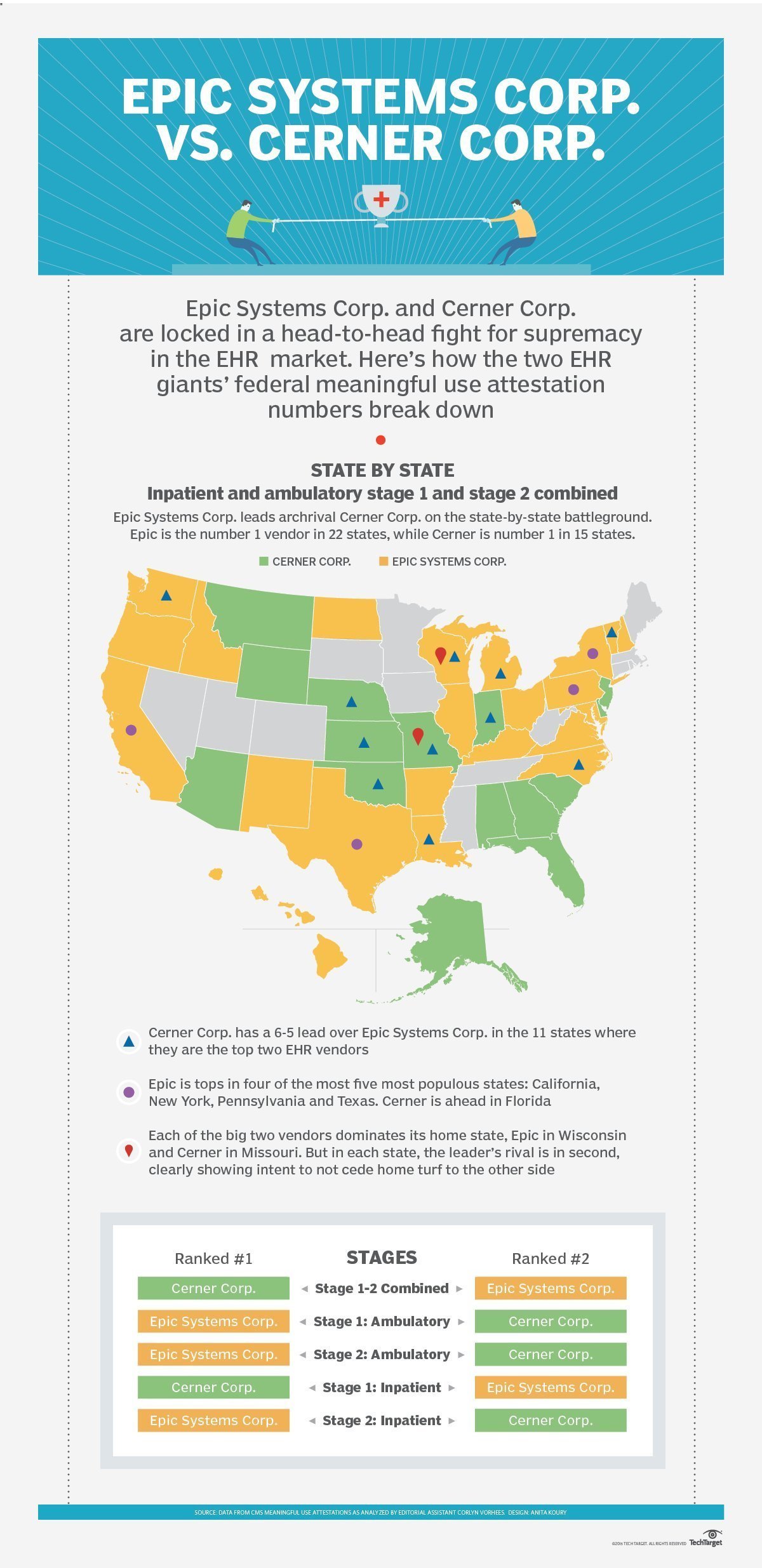

- Global expansion: Epic and Cerner are currently in a battle to gain the majority share of the US market. As you can see in the infographic below, Epic is #1 in 22 states and Cerner is #1 in 15 states. A recent survey also found that Epic is poised to gain even more market share due to prominent mind share so there is still a lot of opportunity to be had. As the battle to gain market share in the US is fierce, Epic will also look to move further into other regions to offset the saturating US market. However, a recent deployment at Cambridge University Hospitals in the UK has led to significant financial issues. Epic's premium pricing position has led to the $300m implementation being met with cynicism over the proposal's value for money. If Epic is to penetrate other regions effectively, it will need to find ways to reduce initial cost outlay.

- Solution improvement in interoperability: Despite scoring the highest mark for interoperability among its competitors in a recent Healthcare IT News consumer survey, it remained the lowest scoring element of Epic's scorecard (see below.) This is evidently an industry wide issue that needs to be addressed.

- Bolster analytical capabilities with IBM's Watson: Epic has a large foundation of patient data and information. As it continues to gain market share in hosting this information, it will also aim to improve its analytical capabilities to derive real value from this data. Epic's experience with IBM on the DoD bid in working jointly with Mayo Clinic has forged a relationship which will see Epic explore how Watson's cognitive computing capabilities could be applied into Epic's EHR base.

- Develop mobile health applications: Epic announced in late 2014 that it is building a data center to transition its healthcare IT apps to a cloud-based model due to growing demand. Coupled with this, Epic also announced that it would be working with Apple to develop mobile health applications for Apple HealthKit. Cloud-based health applications connecting healthcare providers and patients to Epic's EHR will improve its standing in the mobility space.

Jonathan Cordwell

Research Analyst, Healthcare Strategy

ResearchNetwork, CSC

- TechTarget, Infographic: Epic leads Cerner in battle for EHR market, http://searchhealthit.techtarget.com/news/4500250294/Infographic-Epic-leads-Cerner-in-battle-for-EHR-market, 21st Jul 2015

- EHR Intelligence, Epic Systems Tabbed to Expand Hold of Ambulatory EHR Market, https://ehrintelligence.com/news/epic-systems-tabbed-to-expand-hold-of-ambulatory-ehr-market, 13th Oct 2015

- Healthcare IT News, Epic EHR adds to UK hospital's financial mess, http://www.healthcareitnews.com/news/epic-ehr-adds-uk-hospital-money-woes, 28th Sep 2015

- Healthcare IT News, 2015 EHR Satisfaction Survey vendor report card: Epic, http://www.healthcareitnews.com/infographic/2015-ehr-satisfaction-survey-vendor-report-card-epic, 9th Sep 2015

No comments:

Post a Comment