The Telegraph recently published an article based on the announcement that high street pharmacies will be given access to NHS medical records in a move that has provoked privacy campaigners. There are arguments both for and against this move, which I have listed below:

Con

- The process: A large part of the argument against this move is the way in which national policy has been implemented. The test sample on which this policy was based came from just 15 patients. This is very difficult to justify and unfortunately adds to the already significant level mistrust in policy makers.

- The hard sell: There is concern that giving access to sensitive data to large commercial high street pharmacies will lead to the targeting of vulnerable patients with hard sell tactics. Despite the likes of Tesco stating that they would never use this data to market to customers, campaigners are not convinced.

- Confusion over guidelines: The results of the small sample found that pharmacy staff were confused about getting consent from patients before accessing sensitive data. This issue needs to be addressed to avoid data breaches and misuse due to human error or lack of training.

- Data security: Another concern from patients is that loyalty cards may be linked to personal medical records. The number of healthcare data breaches in the past leads to concerns that as medical data would now be bundled with other personal data held by the retailer, the combined value of this data would become more attractive to hackers.

- Confidentiality: One of the most fundamental arguments against this move is that there still remains a large portion of the population who simply do not want to share their data. The NHS has tried to calm these concerns with the insistence that pharmacy staff gain permission before viewing this data but undoubtedly a lot will still be unhappy that they have access to it in the first place.

Pro

- A necessary step: The ultimate goal is for a fully integrated healthcare ecosystem whereby insurers, providers, pharmaceutical companies and indeed the patients work together to improve the health of individuals and the nation. There are a lot of benefits that come from sharing, accessing and utilizing data (especially in mass) but with data kept in silos, this is simply not possible.

- Results of the sample: Although the sample used was incredibly small, the results “proved extremely beneficial”. These benefits have come from individual sites and so if used on a national level (a la population health), economies of scale would be achieved as well as leveraging analytical capabilities to improve healthcare delivery.

- Personalized service: Enabling access to medical data will promote a personal and customized service for the individual patient. A personalized service which aims to improve the health of the population will ultimately also lead to cost savings for the healthcare ecosystem. The bargaining power (although often criticized) of large retailers such as Tesco could also lead to lower pharmaceutical costs.

- Less pressure on family doctors: NHS England claim that sharing medical data with high street pharmacies will ease pressure on family doctors. Doctors will benefit from better processes as well as having a clear view of what pharmaceutical products have been purchased. It's also important to consider that the flow of data should not be one way and can benefit providers as well as pharmacies.

- Reduction in improper medication: A comment on the article also pointed out that some patients may struggle to remember the types of medication they are taking as well as the dosages. With high street pharmacies able to access your file (with your consent), this will reduce the number of instances of patients purchasing and taking the wrong medication or under/overdosing.

Regardless of the criticisms of this rollout, with the right regulations, safeguards and guidelines in place, many commentators believe the personal and social benefits will be become apparent very quickly.

Best Regards,

Jonathan Cordwell

Research Analyst, Healthcare Strategy

ResearchNetwork, CSC

- The Telegraph, Boots, Tesco and Superdrug to get access to NHS medical records, 09 Aug 2015, http://www.telegraph.co.uk/news/health/11790711/Boots-Tesco-and-Superdrug-to-get-access-to-NHS-medical-records.html

For those following the healthcare IT market, you will more than likely already be aware of what has happened between Cognizant and Health Net. For those who are not, I shall quickly set the scene.

In August 2014, Cognizant won a seven year, $2.7b engagement with California-based care management provider Health Net. Service was due to commence in the second half of 2015 but in July, it was announced that Centene Corporation was intending to acquire Health Net, which would delay the contract until after the merger had been completed and may not even go ahead at all due to the overlap with Centene's current IT services vendor landscape. Cognizant instead was able to extend its existing applications outsourcing (AO) and business process outsourcing (BPO) services for Health Net out till 2020 at a value of $520m as well as being able to licence some of Health Net's IP.

So what can we learn from this?

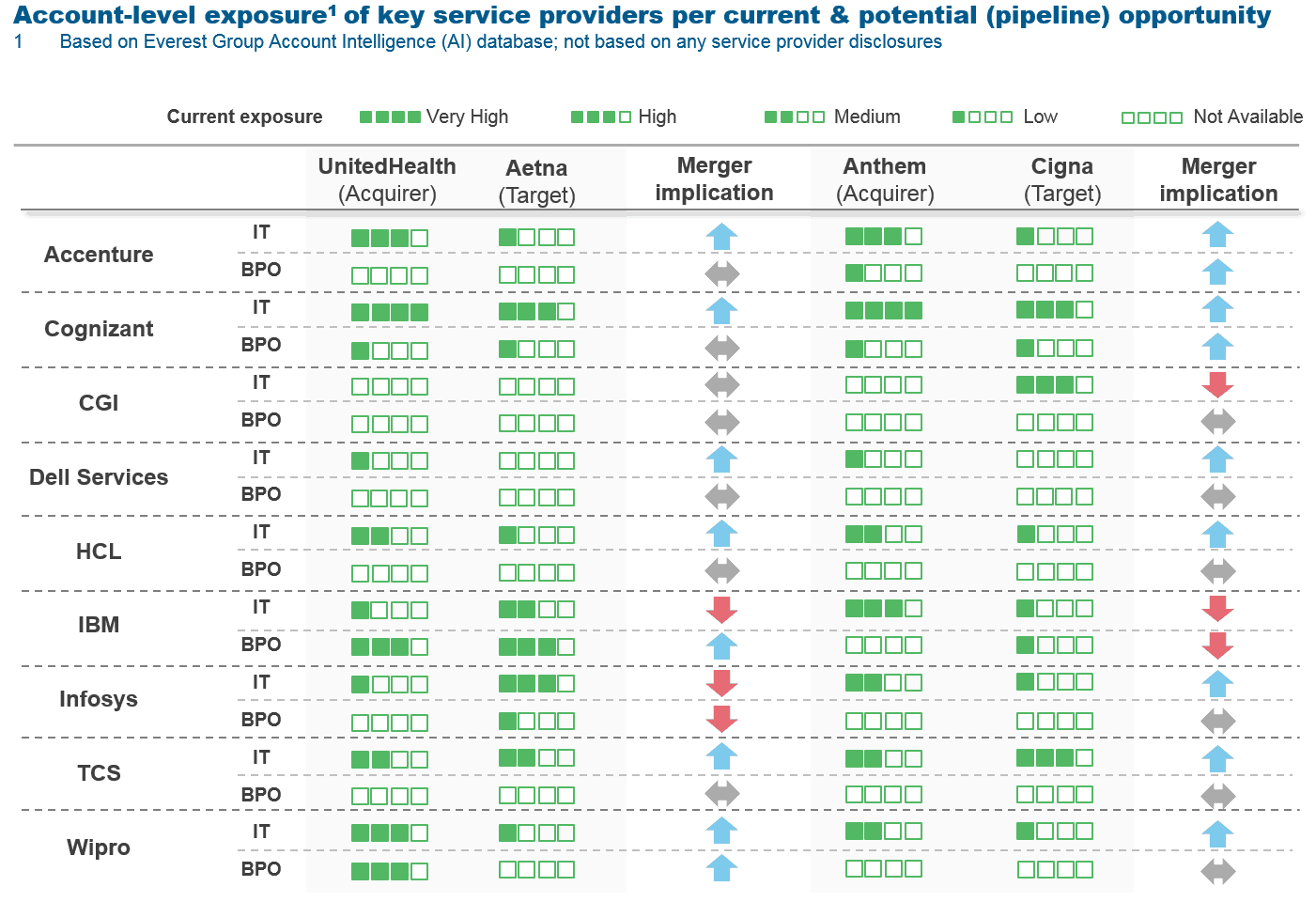

All IT service providers must be on red alert: The chart at the top of this page was produced by Everest (link to the article at the bottom) and shows how deeply entrenched IT vendors are within Healthcare Payer organizations. This chart acts as a warning to all vendors that they should be wary of their current client base and how it could potentially be affected by a merger/acquisition.

The Healthcare Payer ecosystem is shrinking: Centene's intent to acquire Health Net is just one of a series of acquisition announcements in the Healthcare Payer market this year. This was followed by Aetna's $37b purchase of Humana as well as Anthem's $54b purchase of Cigna. Suddenly, we're faced with a market where the top 7 have consolidated into a top 4 in a matter of weeks. There's even speculation that UnitedHealth Group may put in a counter offer for Health Net, which, if higher, would dissolve Centene's offer. These deals have been driven by market changes such as the Accountable Care Act (ACA) and the Supreme Court’s recent decision to subsidize poorer Americans. Keep an eye on UnitedHealth Group to see what its next move will be.

Consolidation equals both opportunities and threats for IT service providers: Although Cognizant's deal may have gone sour after the announcement, it looks as though they will survive after renegotiating the existing AO & BPO contract. As other Payers consolidate, existing deals may come under threat and clients may look to consolidate their vendor landscapes but new opportunities will arise as the newly merged organizations require IT support to ensure the transition goes smoothly and that IT systems are integrated properly.

Thank you once again for taking the time to stop by, I hope you found this interesting and thought provoking. If you have any comments, feel free to leave them below and share via social media.

Best Regards,

Jonathan Cordwell

Research Analyst, Healthcare Strategy

ResearchNetwork, CSC

- Everest, Health Net – Centene Merger Leaves a (Slightly) Bitter Pill for Cognizant, 6th July 2015, http://www.everestgrp.com/2015-07-health-net-centene-merger-leaves-a-slightly-bitter-pill-for-cognizant-sherpas-in-blue-shirts-18205.html

Care Coordination is a key concern in the UK healthcare landscape as it is globally. The need for systems to be integrated in order to reap business process benefits as well as capitalizing on the sheer mass of data that healthcare organizations produce on a daily basis is driving healthcare providers to seek out assistance from IT service providers to not only establish an integrated infrastructure but to also guide them through the possibilities of what value can be attained through this exercise. Today, I look at three characteristics of the UK healthcare ecosystem and its current status with coordinated care.

- Healthcare providers struggle to coordinate care outside of the hospital: Between 2013 and 2014, the National Survey of Bereaved People (VOICES) was commissioned by the NHS to assess experiences of care in the last three months of patients' lives. The key point that stood out the most in my opinion was that healthcare providers struggle to coordinate care when the patient is outside of their usual care setting whether that be a hospital or at home. By no means is there a lack of technology in this area to enable coordination as there is a multitude of devices and means of communicating between care sites. The healthcare ecosystem however struggles with streamlining, integrating and standardizing workflow processes and in conjunction with telehealth technological developments, this is where IT service vendors need to be able to add value to their clients and ultimately their patients.

- The introduction of the NHS vanguard sites demands care coordination: In January 2015, the NHS launched a program inviting individual organizations and partnerships to apply to become 'vanguard sites'. These are, in essence, test cases for new models of care going forward. Looking at the requirements set forth by the NHS, it is clear that success will not be possible without coordinated care. Throughout the ideologies of what the new models of care will look like, we see direct references to becoming an "integrated provider", having a "joined-up electronic health record" and using "patient population segmentation". In fact, the description of 'Enhanced health in care homes', even references how new telehealth technologies can be applied to provide better care. Together with MarketsandMarkets' forecast that the Population Health Management market will grow at a staggering 26% CAGR between 2013-2018, this further supports the need for IT vendors to sharpen up their integration capabilities and offer solutions that genuinely deliver coordination across the IT landscape.

- The NHS is investing in support for harnessing technology such as interoperability: On the 31st July 2015, the NHS published a support pack for all vanguard sites. In section 5 of this document, it speaks to what will be made available for participating vanguard sites. Apart from a £200m transformation fund (of which around £140m remains unallocated as of this blog post), they plan to provide dedicated support for items such as interoperability, information governance and digital strategy. They are also looking to leverage best practice examples both from within and outside of the UK and so IT vendors will need to ensure they have solid case studies to back up their sales pitches.

Best Regards,

Jonathan Cordwell

Research Analyst, Healthcare Strategy

ResearchNetwork, CSC

- Office for National Statistics, Statistical bulletin: National Survey of Bereaved People (VOICES), 2013, http://www.ons.gov.uk/ons/rel/subnational-health1/national-survey-of-bereaved-people--voices-/2013/stb---national-survey-of-bereaved-people--voices-.html?format=print

- NHS England, New care models – vanguard sites, http://www.england.nhs.uk/ourwork/futurenhs/5yfv-ch3/new-care-models/

- MarketsandMarkets, Population Health Management Market worth $40.6 Billion by 2018, http://www.marketsandmarkets.com/PressReleases/population-health-management.asp

- NHS England, Vanguard support package launched, 31 July 2015, http://www.england.nhs.uk/2015/07/31/vanguard-support/